Roger J. Mason is a retiree of Columbus City Schools. The Pickerington resident taught history.

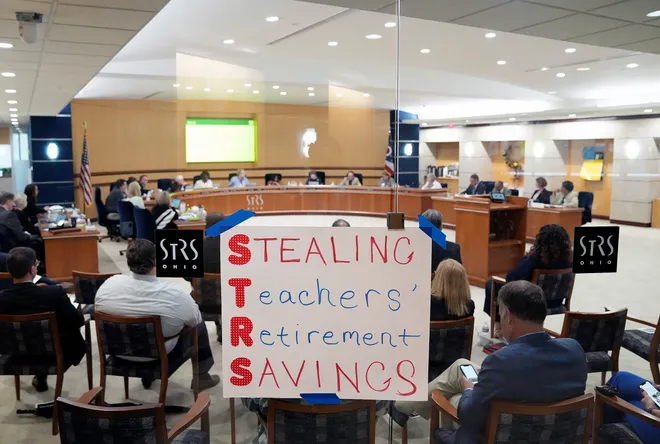

The movement to privatize the State Teachers Retirement System bears a disturbing resemblance to the horrific behavior of corporate raiders during the ’70s and, most especially, the ’80s in America.

These investment groups purchased hundreds of struggling companies in this era under the guise of making them operate more efficiently.

In their words, they intended to cut the fat and therefore rescue these companies from failure. Reality wound up being very different from this attractive-sounding narrative.

It sounded great at first

Each of these purchases began with an immediate mass lay off of highly paid union employees. This, of course, goosed the stock price, which went into the pockets of the raiders. It sounds great, but only in the short run.

The next step was to quickly sell off any other valuable assets like real estate, machinery and intellectual property at fire sale prices. Which, of course, went into the pockets of the raiders again. There is a pattern here.

In a vacuum, all of these moves sound like solid business practice. After all, investors are the risk-takers, right?

Tragically, it only signaled the beginning of the real plan: a sudden and supposedly unforeseen declaration of bankruptcy, which in turn made the liquidation of the legacy pension plans possible.

Wolves in sheep’s clothing

In reality, these raiders had no intention of saving anything. Millions of Americans would lose their jobs. As for the otherwise healthy fully financed pension plans, they would be summarily reduced by bankruptcy court settlements to a few thousand dollars and offered as a lump sum or as a monthly pittance of what it should have been for men and women who paid into those plans for decades.

So, what actually happened to the balance of the money in the pension plans, often worth tens and sometimes hundreds of millions of dollars? Sadly, it would go into the pockets of the corporate raiders as spoils of their supposed risk.

Ironically, under the old system, the money in the pension plan would be untouchable by the legacy business owner. However, a series of new laws allowed the raiders to pilfer this money while placing millions of Americans on government-funded welfare programs for the elderly and poor.https://omny.fm/shows/dispatch-on-demand-audio/playlists/then-what-happened/embed?style=cover

To add insult to injury, the raiders would claim a net operating loss due to the reported loss of value of the original company, which meant that all federal tax liability—for the raiders and their new profits—ccould be erased for years, no matter the source.

Thus, the Treasury became deprived of what should be paid, leaving the burden to a less sophisticated, more gullible population of American citizens who cheer for more privatization, no matter the consequences.

All of the above was—aand still is—mmade possible by our elected officials, who drafted these laws at the behest of the aforementioned raiders and their lobbyists.

The experiences of the last 60 years of American industrial history—especially in Ohio—have led me to be wary of anyone who claims to offer “big returns” and “endless benefits.”

If only we would trust the private sector to do a better job than a bunch of overpaid bureaucrats. These terms were selected and underlined to point out how effective they are when they are offered to a gullible audience.

The short answer to any of the issues and controversies surrounding the STRS is to address them with a proverbial scalpel.

If we teachers give over control of our $90 billion nest egg to a group of 21st century raiders, then Don Bartlett and James Steele’s warning issued in their 1992 book “America: What Went Wrong?” will be nothing more than another shameful footnote in history for man. It will be an unmitigated disaster for a group of teachers who spent more than 35 years paying into a black hole because when the money is gone, it’s gone forever.